Western countries lend more to heavily indebted African countries

The motivation behind the West's and China's granting of loans to African countries differs considerably. Western countries are more likely to lend to resource-poor and highly indebted African countries than China. China's lending to Africa is more driven by its economic interests, lending to countries with richer resources, lower risk of default, and higher willingness to pay for loans. These conflicting interests jeopardize much-needed debt relief for African countries, according to a new study by the Kiel Institute that examines lenders’ motives for lending to African countries.

“Our study fills a gap in the research on China's lending to African countries. Until now, there has been a lack of an explicit benchmark to examine the differences and underlying motives of lending countries. In our study, we systematically compare China's lending with that of six major Western countries—France, Germany, Italy, Spain, Japan, and the United States,” says Eckhardt Bode, author of the study. “One of the key findings is that China’s current approach to lending and debt in African countries is likely to exacerbate a looming debt crisis.”

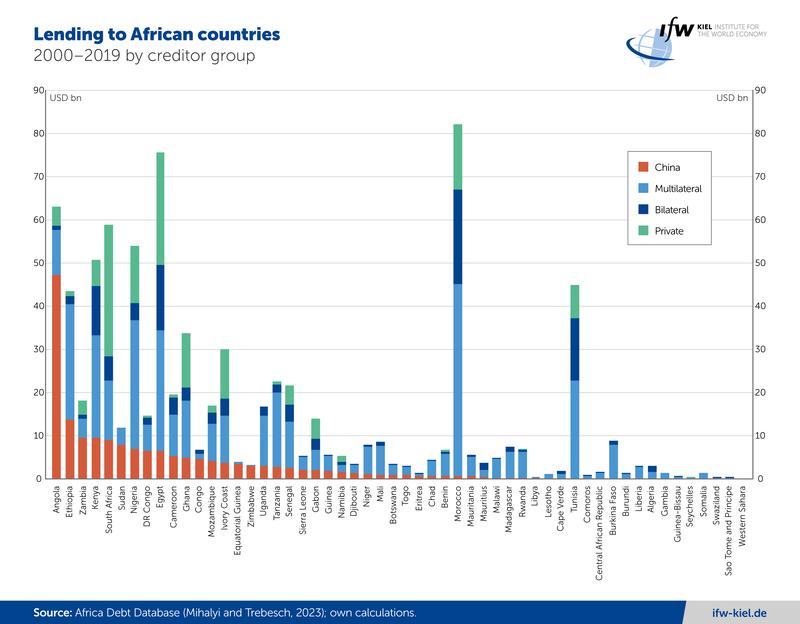

Based on the Kiel Institute’s Africa Debt Database (https://www.ifw-kiel.de/publications/who-lends-to-africa-and-how-introducing-the-africa-debt-database-20876/), a comprehensive dataset that includes nearly 7,000 loans from China, Western countries, and multilateral organizations to African countries, the study analyzes lending data from 2000 to 2019 and found that China's motives for lending in the 2000s differed significantly from those of Western countries.

China’s motives for lending

The economic motives for China's lending in Africa arguably include promoting China's own economic growth and ‘going global’ strategy by promoting trade, gaining access to natural resources, and securing foreign direct investment by Chinese companies, as well as investing its vast foreign exchange reserves abroad and stimulating global demand for goods that are in oversupply at home.

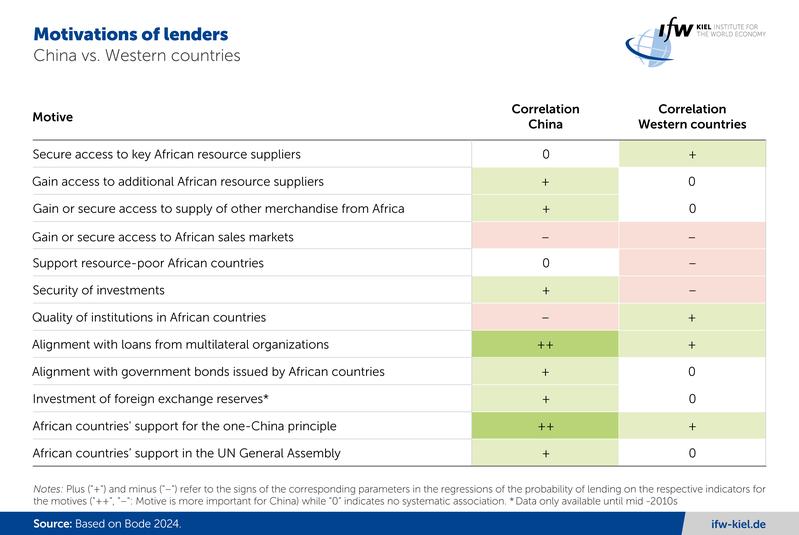

Access to Africa's resources and markets is, in fact, part of the economic motives of both China and the Western countries. While Western countries lend more to secure imports from their current African suppliers, China lends more to gain access to additional suppliers.

Distinct differences are shown in the motives of gaining access to supplies of other goods, which is relevant for China but not for Western countries, and in investment security or profitability, with China preferring to lend to more creditworthy countries to limit the risk of default while Western countries lend to more heavily indebted African countries. In addition, Chinese lending took advantage of African countries' greater willingness to pay for credit by charging disproportionately high interest rates on its loans to those countries that are simultaneously issuing expensive government bonds on international capital markets. By contrast, the motives of Western countries appear to be at odds with such self-interest— given their lending to resource-poor or highly indebted countries and their charging lower interest rates for loans that complement the issuance of government bond.

Finally, China's geopolitical motives also differ from those of Western countries. China prefers lending to countries that support the one-China principle—not recognizing Taiwan—and that vote more in line with China's positions in the United Nations General Assembly. Western countries, on the other hand, prefer to lend to better-governed countries.

Africa’s looming debt crisis

“China obviously goes further than Western countries in putting its economic agenda at the center of its lending strategy,” so Bode. “To be fair, we still know too little about the motives of Western lending, however. The fact that Western countries grant more favorable terms and lend preferentially to countries in greater need seems to reflect charitable motives—but it could also be politically motivated.”

Currently, several African countries that have borrowed heavily from China, including Chad, Ethiopia, Ghana, and Zambia, are in financial distress. But due to the still unresolved conflicts of interests and the deep distrust between China and the Western countries, debt settlements under the ‘Common Framework for Debt Treatment’ have been substantially less generous than past settlements reached with Western creditor countries alone.

“China's current unwillingness to compromise in debt negotiations could exacerbate the debt crisis and push more African countries into default. Its current approach is reminiscent of the 1980s and 1990s, when Western lenders took a similarly tough stance with indebted Latin American countries,” says Bode. “These countries then lost a decade to recurring payment problems and delayed economic recovery.”

Read study: The Motives for Chinese and Western Countries’ Sovereign Lending to Africa/https://www.ifw-kiel.de/de/publikationen/the-motives-for-chinese-and-western-countries-sovereign-lending-to-africa-32863/

Media Contact:

Melanie Radike

Communications Manager

T +49 431 8814-329

melanie.radike@ifw-kiel.de

Kiel Institute for the World Economy

Kiellinie 66 | 24105 Kiel | Germany

Chausseestraße 111 | 10115 Berlin | Germany

T +49 431 8814-1

E info@ifw-kiel.de

www.ifw-kiel.de

Wissenschaftlicher Ansprechpartner:

Dr. Eckhardt Bode

Trade

T +49 431 8814-462

eckhardt.bode@ifw-kiel.de

Die semantisch ähnlichsten Pressemitteilungen im idw