US elections—WTO collapse could hit EU economy 4x harder than US tariff wars

Following the US elections, an EU priority should be to defend multilateral trade and global cooperation over its bilateral relationship with the United States. The costs caused by a collapse of the multilateral system could be many times higher than higher tariffs alone. These are some of the findings of a new study by Kiel Institute and WIFO researchers, which examines different realistic US trade policy scenarios and their global implications.

“Regardless of who wins the race for the White House on November 5, 2024, we can expect the US to continue to pursue protectionist trade policies, as they enjoy broad bipartisan support,” says Gabriel Felbermayr, one of the authors of the study. “Of course, the degree of protectionism would be very different. While Harris seems to value multilateral institutions more, a second Trump administration would likely be more isolationist, far less multilateral, and more transactional than a Harris administration.”

The new study “US Trade Policy After 2024: What is at Stake for Europe” (https://www.ifw-kiel.de/publications/us-trade-policy-after-2024-what-is-at-stake-for-europe-33388/?ADMCMD_simTime=1730620800) analyzes the trade policy changes proposed by US candidates Donald Trump and Kamala Harris, by exploring different scenarios.

The most drastic scenario, based on Trump's campaign pronouncements, has emphasized new, higher tariffs, with proposals including a 10 percent surcharge on all imported goods and a 60 percent tariff on Chinese imports.

Global Effects of US Policies

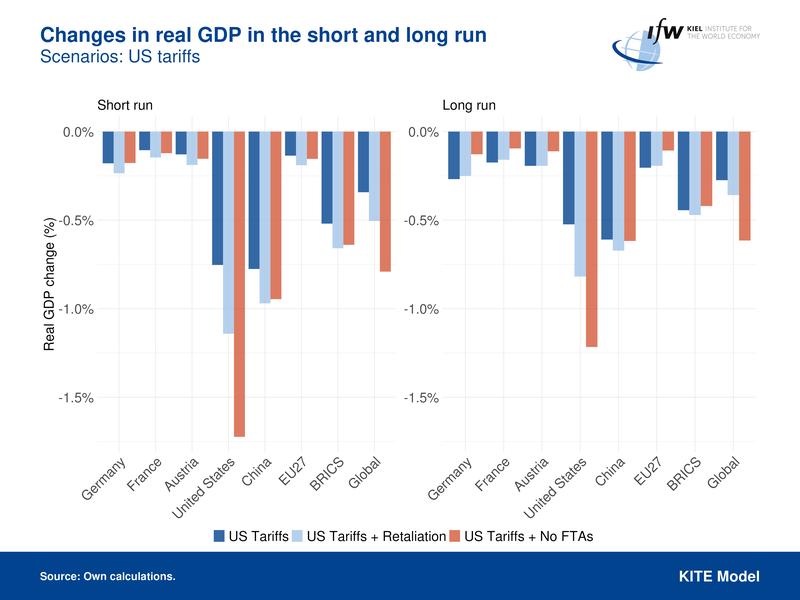

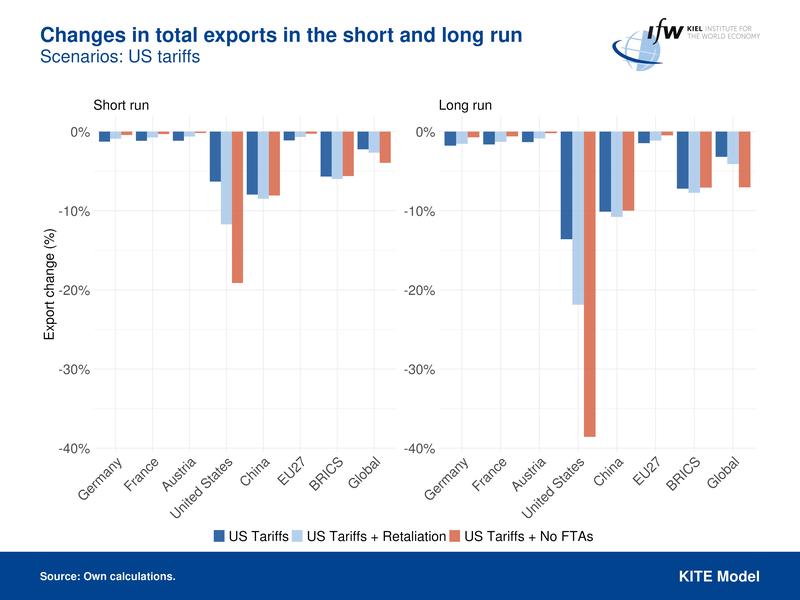

If the US implements these tariffs, global trade could shrink by 2.5 percent in the first year, with long-term declines of around 3 percent. Retaliatory tariffs from trading partners would deepen the impact, especially if the US extends tariffs to partners such as Canada and Mexico, doubling the contraction in global trade. Chinese exports would be reduced by around 10 percent, while US exports would decline by up to 38 percent, because import tariffs on foreign goods also affect the relative prices of exports, leading to similar effects like taxing exports.

In comparison, European countries such as Germany, France, and Austria face smaller export declines under these US policy scenarios. Moreover, in a scenario where the US applies tariffs across the board, including to FTA partners, exports of some EU countries and sectors could actually increase slightly in the short run due to relative price competitiveness. However, despite this increase, EU GDP still declines, showing that the net effect of trade barriers and supply chain disruptions outweighs export gains.

Sectoral Effects

In terms of impact at the country level, there are significant differences between sectors within the affected countries. In Germany, for example, if the US imposes tariffs on all trade partners, overall economic output would decline by 0.1 percent, but some sectors would actually expand.

Service industries might grow by 0.2 percent, while high-tech sectors, such as electronics, could see a 2.5 percent increase in output. Meanwhile, key industries like automotive and pharmaceuticals could experience declines of up to 3.3 percent. This analysis underscores the uneven effects of trade policy shifts on different economic sectors.

Deterioration of Global Economic Cooperation

If Trump wins another term, US policy could also lead to a dismantling of the WTO. As a result, EU real GDP would fall by just over 0.5 percent. Germany would be more negatively affected, the US somewhat less. The biggest losses, however, would be in China. If the world were to fragment into geopolitical blocs led by the US and China respectively, the losses would be significantly higher for the EU and even more so for China. Both together could lower China's real GDP by about 6 percent and Germany's by 3.2 percent in the short run, while the US would be less affected (-2.2 percent). In the long run, the losses would remain about half as large.

“The EU and, in particular, Germany would suffer significantly from a breakdown of the WTO or a fragmentation of the world economy into hostile blocs. The impact on real GDP is substantially greater than unilateral protectionist measures by the US, with effects up to 2 to 4 times larger,” says Julian Hinz, Kiel Institute co-author of the study. “Given that fragmentation’s impact on EU GDP is so much greater, the EU’s highest priority must be to defend the world trade order, including efforts to bolster the WTO’s authority and mechanisms.”

Read Kiel Policy Brief now: https://www.ifw-kiel.de/publications/us-trade-policy-after-2024-what-is-at-stake-for-europe-33388/?ADMCMD_simTime=1730620800

Media Contact:

Melanie Radike

Communications Manager

T +49 431 8814-329

melanie.radike@ifw-kiel.de

Kiel Institute for the World Economy

Kiellinie 66 | 24105 Kiel | Germany

Chausseestraße 111 | 10115 Berlin | Germany

T +49 431 8814-1

E info@ifw-kiel.de

www.ifw-kiel.de

Wissenschaftlicher Ansprechpartner:

Prof. Dr. Julian Hinz

Trade Policy

T +49 431 8814-507

julian.hinz@ifw-kiel.de

Die semantisch ähnlichsten Pressemitteilungen im idw