How stock market inefficiencies can affect the real economy

Corporate managers’ investment behavior is affected by waves of investor optimism and pessimism. Hence, the performance of an investment factor can be predicted. A dynamic trading strategy that is based on signals from past flows between bond and equity mutual funds and the investment factor generates a significant annual alpha of 7%.

Mutual fund investors are known to be vulnerable to fluctuating market conditions. What is less well understood is how corporate managers are affected by waves of investor optimism. A Luxembourgish researcher has published a study in the SpringerNature journal ‘Financial Innovation’, where he argues that corporate managers and investors are jointly caught up in market euphoria. Using a long time series of aggregate flows in and out of bond and equity mutual funds as a proxy for investor sentiment, the study's author, Thorsten Lehnert, professor at the University of Luxembourg's Department of Finance shows that the joint “moodiness” of managers and investors can predict the performance of an investment strategy that relies on differences in corporate managers’ investment behaviour.

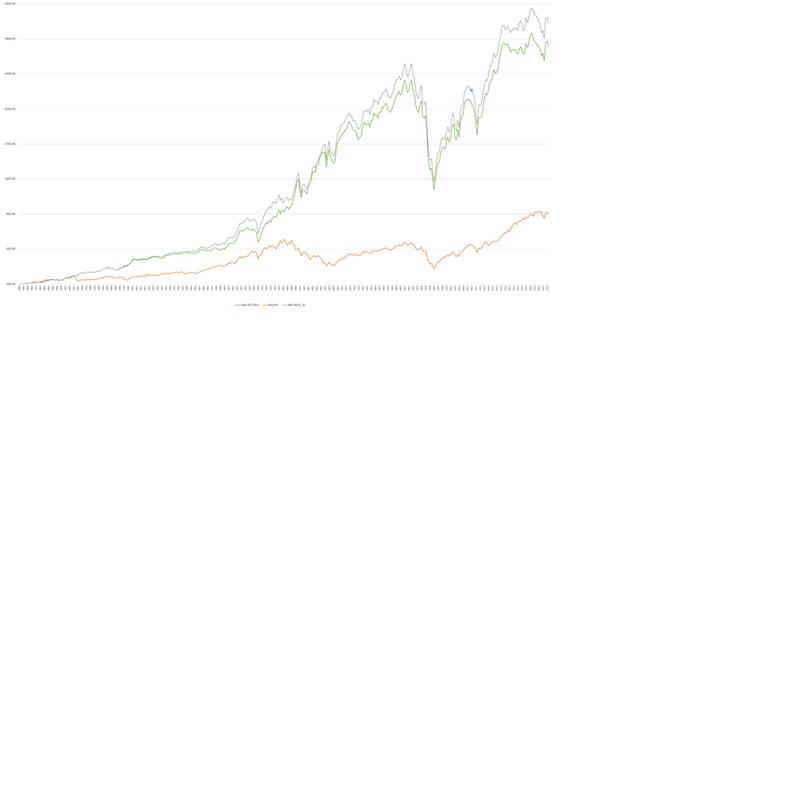

Prof. Lehnert focused on the so-called investment factor, an investment strategies that is long in a conservative investment portfolio and short in an aggressive investment portfolio. He explains that "stock prices of high- and low-investment firms are differentially affected by market-level euphoria. For example, the observed mispricing during periods of euphoria and the subsequent correction is particularly pronounced for a high investment portfolio compared to a low investment portfolio. As a result, the performance of an investment factor can be predicted using information about retail investors’ optimism and pessimism."

Interestingly, the relationship between past flows and the investment factor is not only statistically significant, but also economically significant. The study shows that, overall, a related trading strategy consistently and significantly outperforms static strategies and generates significant annual alphas of 7% after accounting for well-known risk factors. Interestingly, the flow measure, which serves as a proxy for market-level euphoria, dominates other well-known indicators of investor sentiment.

"So far, the common view is that retail investors are ‘moody’ and exhibit irrational trading behavior. My explanation that corporate managers and investors are jointly caught up in market euphoria offers a novel perspective on how financial markets can affect the real economy”, Prof. Lehnert explains. “It appears that stock market inefficiencies matter even for real decisions of firms,” he concludes.

Wissenschaftlicher Ansprechpartner:

Thorsten Lehnert, Department of Finance, University of Luxembourg, Luxembourg, thorsten.lehnert@uni.lu

Originalpublikation:

Lehnert T., Corporate managers, price noise and the investment factor, Financial Innovation, 8, 61.

Weitere Informationen:

https://doi.org/10.1186/s40854-022-00365-2

Die semantisch ähnlichsten Pressemitteilungen im idw