Kiel Institute summer forecast: Weak winter pushes economy into negative territory 2023

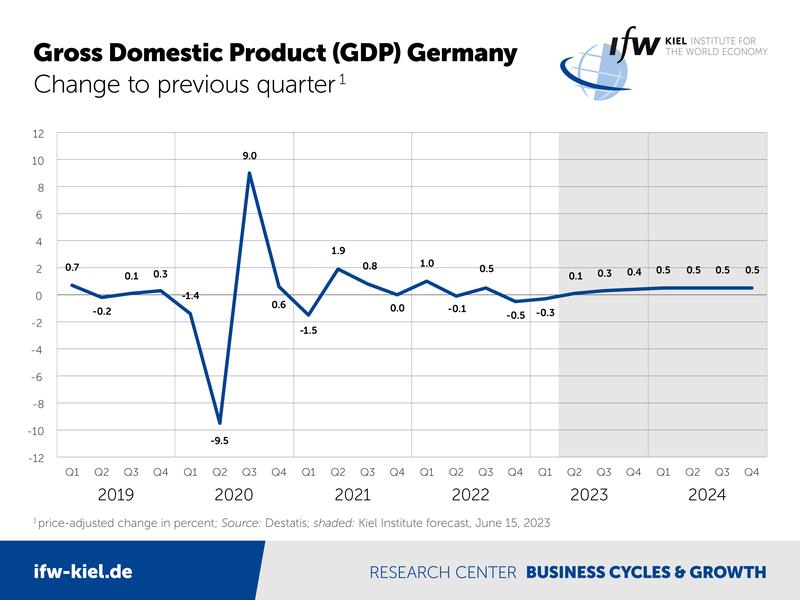

Economic output in Germany is set to decline in 2023. The Kiel Institute for the World Economy expects a year-on-year decline of 0.3 percent, significantly downgrading its spring forecast (+0.5 percent). The main reason for this is the weak winter half-year. However, moderate expansion is expected for the rest of the year. For 2024, the Kiel Institute now expects growth of 1.8 percent (previously +1.4 percent). Inflation is expected to fall significantly over the course of the year and only amounts 2.1 percent in 2024.

"Given the severity of the crisis and the halt in supplies of oil and gas from Russia, the German economy is doing valiantly, confirming its ability to adapt quickly to new circumstances," said Moritz Schularick, president of the Kiel Institute. "But it's also clear that the energy crisis has left its marks."

"The outlook for the German economy is better than the negative annual rate for GDP would suggest. A still large catch-up potential after the Covid-19 pandemic, high order backlogs in industry and soon strong increases in purchasing power with a stable labor market are the ingredients supporting the economy," comments Stefan Kooths, head of forecasting at the Kiel Institute, on the current summer forecast for Germany (German Economy in Summer 2023: Crawling out of the crisis/https://www.ifw-kiel.de/publications/kiel-institute-economic-outlook/2023/german-economy-in-summer-2023-crawling-out-of-the-crisis-18335/) and the global economy (World economy in summer 2023: Growth remains subdued/https://www.ifw-kiel.de/publications/kiel-institute-economic-outlook/2023/world-economy-in-summer-2023-growth-remains-subdued-18240/).

Compared with the spring forecast of the Kiel Institute, however, the aftermath of the energy crisis and the tight monetary policy had a somewhat greater impact on the German economy in the winter half-year than initially expected. In addition, two special effects—an unusually high level of sick leave and a slump in government consumption following the end of the Covid-19 measures—had a noticeable dampening effect on economic performance. Labor shortages and supply bottlenecks continue to weigh on the economy. At present, gross domestic product (GDP) is still 0.5 percent below the level before the outbreak of the Covid-19 pandemic.

"Overall, the German economy is caught between considerable scope for expansion and, so far, quite stubborn production-side obstacles. To the extent that these are gradually overcome, economic output can also pick up again," says Kooths.

Energy prices, and with them the rate of inflation, are declining over the course of the year, with energy prices expected to fall by over 6 percent next year. The Kiel Institute now expects inflation of 5.8 percent (2023) and 2.1 percent (2024).

However, core inflation—excluding energy—remains historically high. It will be 2.9 percent next year, compared with a long-term average of 1.4 percent.

Consumption picks up, service industries gain ground

The purchasing power of many people is already increasing noticeably in the further course of the year thanks to strong wage growth and higher social benefits combined with lower inflation. This is giving a boost to private consumption, which has recently been very weak. On an annual basis, this is only reflected in the figures for 2024 (2.7 percent), following a decline of 1 percent in the current year.

"Some of the drastic upward pressure on prices, which initially caused profit margins to rise, is now reaching employee households in the form of higher wages. This normalizes the distribution structure, which drives consumption without driving up inflation on the cost side," says Kooths.

This will benefit the service sectors in particular, such as the retail trade, hotels, and restaurants. They can expect strong increases in value added again and gradually make up for the losses previously suffered.

Labor market robust, government deficit declining

The crisis in construction as a result of higher interest rates and still very high construction prices is continuing, with investments in residential construction in particular declining noticeably by -4.2 percent (2023) and -3 percent (2024).

On the labor market, the effects of the energy crisis will remain manageable. The unemployment rate is expected to rise slightly from 5.3 percent (2022) to 5.6 percent (2023) and then fall again to 5.3 percent (2024). Due to the aging of the population, employment is expected to peak in the current year at a good 45.9 million and then decline.

Deficits in public budgets are declining. Key factors are the elimination of crisis-related spending and rising social security revenues. The government deficit falls from 2.7 percent (2022) to 1.7 percent (2023) and 0.9 percent (2024). The debt-to-GDP ratio will then be 63 percent.

Outlook for global economy brightens somewhat

Global production is expected to increase by 2.8 percent (2023) and 3.0 percent (2024), following 3.3 percent last year. On the positive side, energy prices have fallen significantly again, the prospects for steady expansion have improved in China with the abandonment of the zero-covid policy, and supply bottlenecks are no longer an unusually strong impediment to economic activity. However, the sharp tightening of monetary policy, which has led to significantly higher financing costs and reduced the propensity to spend, is having a braking effect.

Read Reports now:

- German Economy in Summer 2023: Crawling out of the crisis (https://www.ifw-kiel.de/publications/kiel-institute-economic-outlook/2023/german-economy-in-summer-2023-crawling-out-of-the-crisis-18335/)

- World economy in summer 2023: Growth remains subdued (https://www.ifw-kiel.de/publications/kiel-institute-economic-outlook/2023/world-economy-in-summer-2023-growth-remains-subdued-18240/)

Our subject dossier Economic Outlook (https://www.ifw-kiel.de/topics/economic-outlook-9576/) provides an overview of all our forecasts.

Click here for more information on the Kiel Institute's Forecasting Center: https://www.ifw-kiel.de/institute/research-centers/business-cycles-and-growth/

Media Contact:

Mathias Rauck

Press Officer

T +49 431 8814-411

mathias.rauck@ifw-kiel.de

Kiel Institute for the World Economy

Kiellinie 66 | 24105 Kiel | Germany

T +49 431 8814-774

F +49 431 8814-500

www.ifw-kiel.de

Wissenschaftlicher Ansprechpartner:

Prof. Dr. Stefan Kooths

Director Business Cycles and Growth

T +49 431 8814-579

T +49 30 2067 9664

stefan.kooths@ifw-kiel.de

Ähnliche Pressemitteilungen im idw